.jpg)

Ĭapital gains and deductible capital losses are reported on Form 1040.

#2018 long term capital gains tax brackets free

Get all the numbers you need at your fingertips with our free 2018 desktop reference. If you hold it one year or less, your capital gain or loss is short-term.Ĭapital gains rates, individual and corporate tax rates, deductions/exemptions, and more. If you hold the asset for more than one year before you dispose of it, your capital gain or loss is long-term. Losses from the sale of personal-use property, such as your home or car, are not deductible.Ĭapital gains and losses are classified as long-term or short-term. You have a capital loss if you sell the asset for less than your basis.

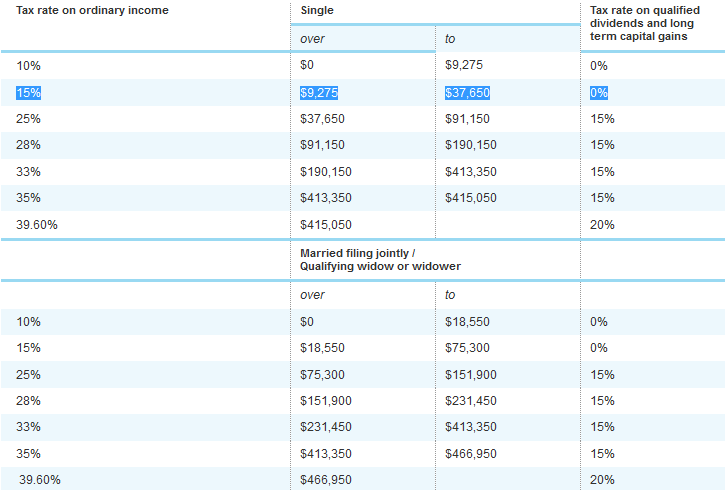

You have a capital gain if you sell the asset for more than your basis. When a capital asset is sold, the difference between the basis in the asset and the amount it is sold for is a capital gain or a capital loss. 1 Examples are a home, household furnishings, and stocks or bonds held in a personal account. Why You're Smart to Buy Shopify Inc.Almost everything owned and used for personal or investment purposes is a capital asset. The $16,122 Social Security Bonus You Cannot Afford to Miss The point is that the long-term capital gains tax rates discussed here reflect the current tax law, and there's a possibility that this information could change.ĥ Expected Social Security Changes in 2018Ħ Years Later, 6 Charts That Show How Far Apple, Inc. To be clear, we don't have a single tax reform plan yet, and the eventual changes will likely be a compromise between the House and Senate versions of the Tax Cuts and Jobs Act, which are quite different at this point, so there's no way to know what kind of changes could be in store. While neither bill that has been revealed thus far changes the capital gains tax rates, both would change the income ranges to which each rate would apply. The 2018 long-term capital gains tax structure could change significantly if the GOP passes a tax reform bill. It's also important to remember that certain high-income taxpayers pay an additional 3.8% net investment income tax, which kicks in above certain income thresholds.ĭata Source: IRS. Finally, a 20% long-term capital gains tax rate applies to taxpayers in the highest (39.6%) tax bracket. A 15% long-term capital gains tax rate applies to the next four brackets - 25%, 28%, 33%, and 35%. A 0% long-term capital gains tax rate applies to individuals in the two lowest (10% and 15%) marginal tax brackets. Meanwhile, long-term capital gains are taxed at one of three potential rates - and all are much lower than the corresponding marginal tax rates. Short-term capital gains are taxed as ordinary income, which means your marginal tax rate will apply to your short-term gains as well. The reason for the distinction is that long-term capital gains are taxed at more favorable rates than short-term gains. A long-term capital gain is made on an asset you owned for at least 366 consecutive days. A short-term capital gain is defined as a gain made on assets that you owned for one year or less. The IRS sorts capital gains into two categories: long-term and short-term. For example, if you bought a stock for $40 per share and sold for $50, you'd have a $10 capital gain for each share you sell. What is a long-term capital gain?Ī capital gain occurs when you sell property, such as a stock, at a price that's greater than what you paid for it. tax forms sitting on top of money, with a pencil on top.

0 kommentar(er)

0 kommentar(er)